You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GEN 2 Has anyone in AZ bought below MSRP?

- Thread starter highwhey

- Start date

Disclaimer: Links on this page pointing to Amazon, eBay and other sites may include affiliate code. If you click them and make a purchase, we may earn a small commission.

Lacajun25

Active Member

For AZ new vehicle purchased out of state:

The MVD will add sales tax when you go to register it.

Then you'll get a bill for sales taxes separately from your city. That's what Chandler did when I bought a new motorbike and had shipped in to me.

If you want to buy with zero taxes, get a slightly used '19 private party either from out of state or in state.

Wouldn’t you still have to pay a tax when you register with the DMV? In Texas, you’re supposed to pay a tax based on 80% of the value based on an online valuation tool. That’s what I see online but I don’t know how well it’s enforced.

Sent from my iPhone using Tapatalk

gtbguy

Member

For AZ new vehicle purchased out of state:

The MVD will add sales tax when you go to register it.

Then you'll get a bill for sales taxes separately from your city. That's what Chandler did when I bought a new motorbike and had shipped in to me.

If you want to buy with zero taxes, get a slightly used '19 private party either from out of state or in state.

I was referring to the city tax, yes everybody has to pay sales tax and to every state.

dreys

Full Access Member

i tried searching for 2019 invoice pricing, anyone have that info?

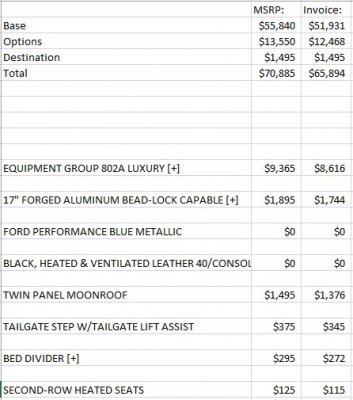

Invoice pricing is 7% off windows sticker MSRP.

Each dealer also gets ~$2k in dealer holdback, which is the amount dealer gets from Ford, regardless of sale price.

In other words, if they sell you at invoice, they'll make $2k. If they sell above it, that's additional cash for them.

Last edited:

Wouldn’t you still have to pay a tax when you register with the DMV? In Texas, you’re supposed to pay a tax based on 80% of the value based on an online valuation tool. That’s what I see online but I don’t know how well it’s enforced.

Sent from my iPhone using Tapatalk

I was referring to the city tax, yes everybody has to pay sales tax and to every state.

It depends on the State(s). If I pay Sales tax in any State, then, when I go to AZ MVD to register it they figure what the sales/use tax is. If AZ's sales/use tax is more than I paid in the other State then I would pay the difference, if it's less then I would pay zero.

If it's used and a private party sale, either bought in state or out of state, you don't pay sales/use tax in AZ. If the seller also resides in AZ they can go to the MVD website or in person and submit a form to get their unused portion of Registration/Vehicle License Tax refunded.

I (being in AZ) have bought a used vehicle from a dealer in CA and had the dealer ship it to me in AZ. Zero sales/use tax paid in CA. Nor, did AZ MVD collect any sales/use tax.

I (being in AZ) have bought a new vehicle from a dealer in CA and had the dealer ship it to me in AZ. Zero sales/use tax paid in CA. I paid AZ State sales/use tax based on MSRP (of the model only, not options) at the time of registration. My city sales/use tax was billed to me at a later date.

I bought a used vehicle private party in CA and trailered it home. Zero sales/use tax paid in CA. Nor, did AZ MVD collect sales/use tax when I registered it.

Lacajun25

Active Member

Ah, makes sense now with your explanation for AZ. That almost makes me want to move to AZ. Except for the crazy summer heat: wait, it’s hot here in TX as well. I’d end up losing by moving there from the income tax though.

Sent from my iPhone using Tapatalk

Sent from my iPhone using Tapatalk

Ah, makes sense now with your explanation for AZ. That almost makes me want to move to AZ. Except for the crazy summer heat: wait, it’s hot here in TX as well. I’d end up losing by moving there from the income tax though.

Not necessarily. AZ State income tax is very low. If you look at all taxes you pay, you might reconsider. Property taxes for instance, it varies a bit from city to city but roughly;

$200k home taxed about $1,000 per year,

$400k home is about $2,200,

$600k home is about $3,500.

I've got a buddy outside of Dallas and he says he pays way more than I do in property taxes for a similarly priced home.

If you live north of Phoenix in high country the heat is a not an issue, but dang that snow. If you live south east of Tucson it's much milder in both summer and winter.

soulkitchen

Member

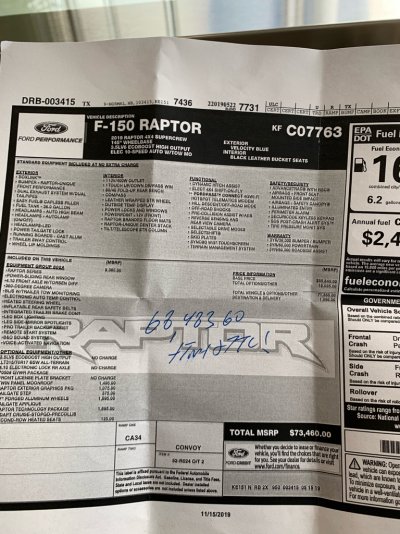

I bought the last 19' Chapman Ford had today. Well below invoice, I will try to post numbers tomorrow. I talked to just about every dealer in the Phoenix area for last month or so. finally pulled the trigger, MSRP was just under 74K i believe. Autonation Scottsdale has one or two agate 19's left. Peoria pulled a bait and switch price wise once I got out there. Bell wont work with you at all. Earnheardt couldn't get to where I needed to be for a 75 mo loan.

Similar threads

- Replies

- 14

- Views

- 2K

- Replies

- 9

- Views

- 752

- Replies

- 2

- Views

- 374

- Replies

- 21

- Views

- 2K

- Replies

- 24

- Views

- 1K