Replying to my incomplete post from above:

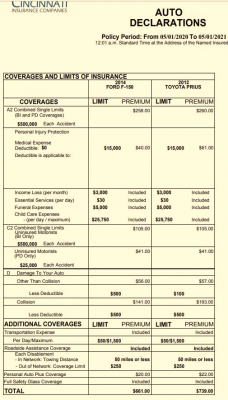

Most policies are split, like 100/300/100 as I'm sure you guys all know. Mine is called combined. It covers in my case 500k worth of damage, total, but does include bodily injury, uninsured motorist, property damage uninsured motorist coverage, personal injury protection, glass, and some info on rental cars with what I think is a max per day of 50.00 with a cap of 1500.00 dollars. I could send a snip of this if you wanted to see more details, but my wife's Prius is on there too and some of you would probably go blind just seeing the word. The deductible is 500.00 dollars for my policy, less for her Prius.

I had to call in and ask because I forgot the details of the plan. I can wrap my head around axle and compression ratios a lot better than I can on insurance declarations I'm sorry to say.

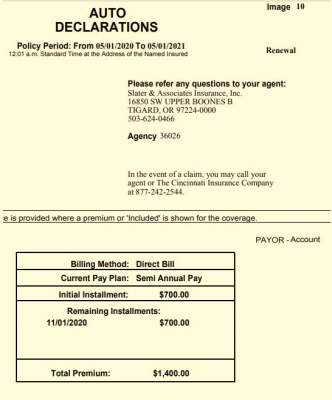

I pay 661.00 per year, so 55.00 per month for a 14 F150 5.0 liter. My Raptor will bump that up about 150.00 dollars per year, so that's 68.00 approx per month. I'm 55, no speeding tickets in the last at least 8 years, no accidents. Finally reaping the advantages of getting older. This seems low I know, so here are snips from the policy. Annual premium is 1400.00, we that semi-annually as you can see.