TomDirt

FRF Addict

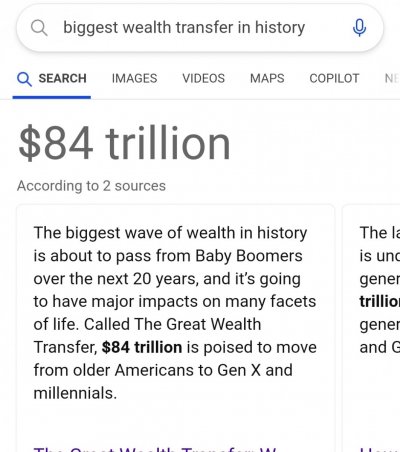

It's been stated that everyday, another 10,000 people retire. Their bi-weekly investments will stop, and most will start drawing from their savings instead.The combined wealth transfer happening in the near future is going to change investing forever. The generation behind them is smaller, investing much less, and ultimately will not take up the slack. The tech investment craziness is over, and zombie companies like WeWork are being exposed and it's game over for them.

Investing will not be the same in 2024.

Investing will not be the same in 2024.